Its main objective is to ensure the financial reliability of any organization. The other objectives are Independent opinion and judgment.

According to auditing, the books of accounts must be kept according to the rules specified in the Companies Act and to ensure whether the books of accounts show true and genuine affairs of the company.

Auditing provides confidence for all stakeholders about the accuracy of the organization’s account reports. The accounts of all the public firms must be audited by an independent auditor before declaring the results each quarter.

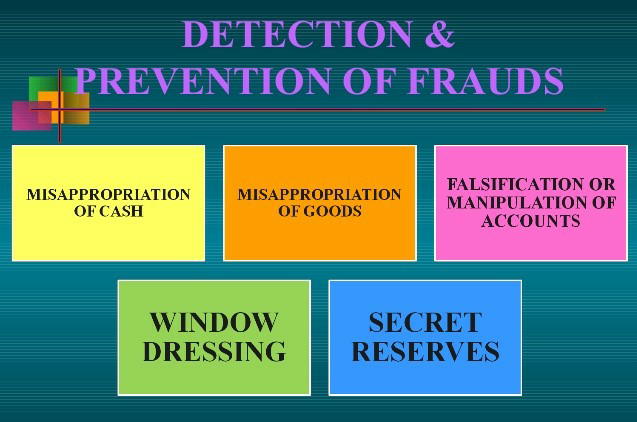

There are three types of fraud:

- Misappropriation of Cash

- Misappropriation of Goods

- Manipulation of Accounts

MISAPPROPRIATION OF CASH:

Misappropriation of cash is the easiest way of fraud especially in large business houses where there is a lack of communication or almost no communication between the owner of the company or organization and the cashier. There are many ways of misappropriation or also known as embezzlement can be done:

- Showing wrong receipts of payments or showing excess payments in the cash book.

- Frightening of cash receipts payment to creditors, workers, and co-companies.

- Showing cash sale as a credit sale.

- The Teeming and Lading method can be used, in this, the money received from any customer can be pocketed then receiving the payment from another customer can be shown as the money received.

For safety and internal control, the work performed by one person should be checked by another person automatically.

MISAPPROPRIATION OF GOODS:

Misappropriation of goods can be done with many ways:

- The goods may be stolen either by employees or with the help of any worker.

- Showing the false credits to customer to return goods.

Misappropriation of goods is not an easy way, its detection is more difficult than that of misappropriation of money, especially when management is not vigilant, adequate system of securities are not available, internal control is missing.

To keep eye on the physical verification of goods with the careful checking of sale and purchase with the reconciliation on physical stock with books.

MANIPULATION OF ACCOUNTS:

The manipulation of accounts are mainly encouraged by the top management and heads of some parties.

This type of manipulation can be done using following ways:

- On showing the higher profits to maintain confidence of shareholders.

- The higher percentage of profit is shown to enhance the credit from the financial institutions, to show the credits to the suppliers of companies.

- To promote more commission as the commission depends upon the profit made.

- The low profit report is shown to pay less Direct Taxes (Income Tax, Wealth Tax) of the company.

Generally, low profits are shown so that company can purchase shares at low price, or to deviate other companies regarding business.