Now- a- days, the auditors do not pursue accurate and specific examination and verifications of the records. The auditors can select the specific portions of entries out of the whole data for making out the conclusion on the whole data with the help of the dynamic internal control system in the organizations.

In the initial years, the process of the examination of all the transactions and verifying entries and records of the business was carried out as a familiar exercise. It is considered outdated in the present modern system of auditing. The auditor resolves on his own about the extent of examination to be applied as there is a negligible statutory obligation for the auditor to examine the complete transactions.

What is audit sampling?

Sampling is an assumption based technique which states that each sample constitutes the same features of the complete data which is being represented by it. Sampling indicates the verification and selection of a portion by accounting records and entries out of the whole familiar data. It offers the auditor to summarize the population-based on various reasons.

The auditor can pursue specific verification rather than just checking all the entries in the books by applying test checks where the appropriate internal control system is accepted by the organization and is widely abided in the auditing and accounting profession.

A certain degree of reliability rather than complete reliable results might be offered by this technique. A minimum degree of reliability of the sample result is accepted in case of the satisfactory internal control system in any organization.

The auditor’s decision for selecting a sample of entries to be verified is based upon the nature, materiality and size of the transactions.

Detection of any error or fraud in the unchecked entries will not create any major effect on the truth and fairness of the financial statements. This is considered as an advantage of this technique. The auditor’s decisions are also made on the basis of other aspects such as accounting standards, arithmetical accuracy, disclosure, provision of law and presentation.

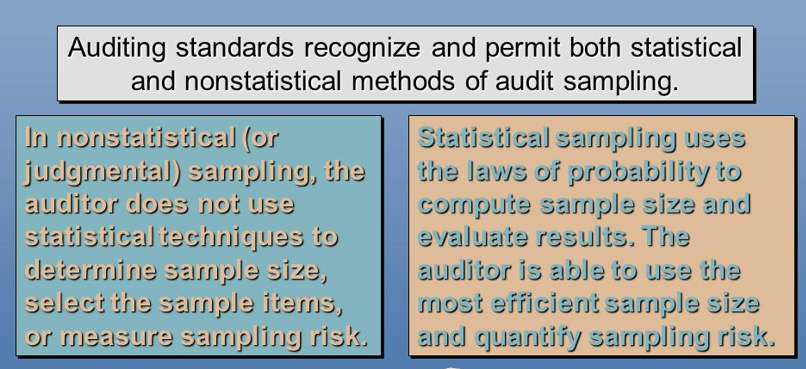

Types of Audit Sampling

The precautions for applying test checking technique are the following-

- The transactions selected for the test check plan should be free from any partiality or unfairness

- The experience of an auditor should be based upon the number of transactions which are included in the test check

- The proper analysis of the complete procedures and processing of transactions should be done

- Identification of any fraud or error during audit should undergo further investigation

- Internal control system of the organization should be analyzed properly to check the application of the extent of the test checks