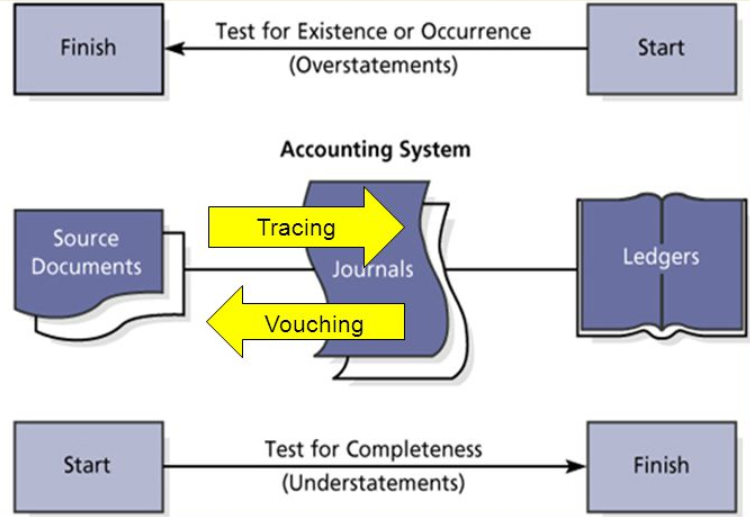

Documentary evidence and inspection of that evidence supports the accounting entries that are made in books. This is known as vouching. By using the technique of vouching, the auditor decides the originality of the accounting entries. The auditor has all motives to feel uncertain about fraud or errors or any other kind of manipulation in the absence of proper supporting documents.

Therefore, the auditing is insufficient with vouching.

The collection of evidences and the evaluation of evidences are the two main functions based upon the evidence in the auditing process.

The collection of evidences is done through confirmation, observation, injury and inspection. The evaluation of evidences is completed with the help of adequacy, validity and relevance.

Objective of vouching

The main objectives of vouching are as follows-

- To ensure the accuracy of all the recorded business transactions in the books of accounts

- Complete verification in order to make transactions free from errors or frauds

- Verification and confirmation of the recorded entries according to the capital and profit nature

- To check the efficiency and accuracy of the accounting transactions

- Verification of proper processing of voucher through all the stages of internal check system

Importance of vouching

The ground for auditing is formed by vouching which is a significant part of the duty of an auditor. The auditor is responsible for the any kind of carelessness in vouching. The auditor cannot get away from his duty because of irresponsible vouching.

The points indicating the importance of vouching are mentioned below-

- The success of audit is totally dependent on the accuracy and efficiency of vouching

- Easy detection of errors and frauds if vouching is carried in an intelligent way

- The auditor can decide to do test checking rather than complete vouching in the presence of adequate internal control system

Audit Trail

Types of voucher

The primary and collateral vouchers are the two main types of vouchers. The primary voucher is an original copy of written supporting document which includes purchase bill, cash memo and many more.

The collateral vouchers are the copies of the supporting documents which are not available in the original form such as duplicate or carbon copy of sale invoice.

There are various other vouchers related to sales, purchase, cash payments and cash received. Sales order, quotations, demand note, duplicate or carbon copy of cash receipt, sales invoice, purchase orders, good inward register, cash memo, contracts and correspondence with payee etc. are the some examples of these vouchers.