Methods of Audit

The method of auditing depends upon the capabilities of auditors and the circumstances of audit. The methods are not hard or easy, it depends upon the situation and the way of execution.

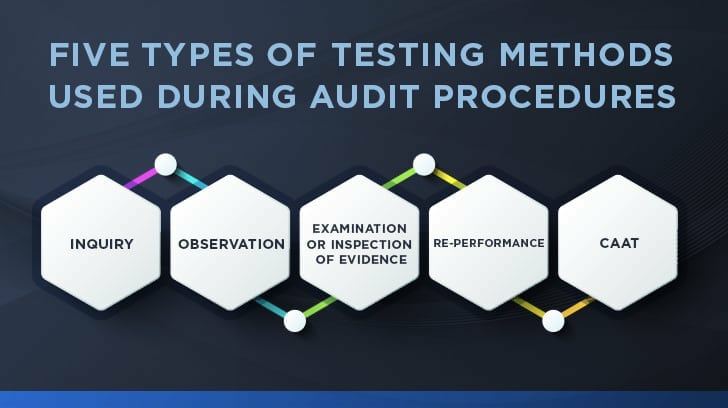

There are mainly five methods to test control in place at the service organization. The methods are arranged in the increasing complexity including inquiry, observation, re-performance, examination, computer-assisted audit technique. These are explained briefly:

- Inquiry: The auditor investigates about the controls in place from the management and employees to gather the relevant information.

- Observation: All the activities and operations performed are tested using observation. This method is used when no documentation is available.

- Examination of pieces of evidence: This method ensures whether the controls are performed or not. It reviews the written documentation or reports, records such as balance sheets, manuals, etc.

- Re-performance: This method is performed only when the above three defined methods fail to provide information that control is operating effectively and successfully. It is the strongest method among all the methods. In this, the auditor executes the control, re-perform the calculations that the system automatically calculates.

- CAAT( computer-assisted audit technique): CAAT is used to analyze large data, and each transaction is analyzed effectively rather than analyzing one of the transactions.

An Auditor should also use the following different classes of transactions like posting, casting, carry forward, bank statement and vouching.

An Auditor can be following methods as precautions −

- In different firms, different ticks should be used for the same class of transactions. The team of the entity should be unaware of these ticks.

- Work should be completed with perfection to avoid mistakes. The Auditor should maintain all the important records, balances and other important documentation in his notebook.

- If the Auditor is requested to do the balancing of accounts particularly in small affairs, he should work as an Accountant rather than an Auditor.

- The auditor should not allow the use of a pencil on any document, use the waterproof pen. If the audits are continuous, work should be completed within a time limit.

The following methods need to be considered while testing−

- The Auditor should select the number of representatives of each class. The employees or entities should be unaware of the method of audit.

- The Method of testing applied in the current year should not be applied in the audit of next year. More attention is required when the chances of error and fraud are high.

- There should be no pre-determined sample in the form of size should be chosen. The auditor should use a materialistic concept during sample choosing.

Please follow and like us: