Detection and Prevention of errors

Detection and prevention of errors is an essential audit objective because without achieving the points, the objective cannot be gained. To detect errors, the auditor must perform his duties.

As per the Statement of the Institute of Chartered Accountants of India states on the rules of auditing, an auditor should ensure the possibility of the existence of frauds or errors in the accounts.

- Errors in auditing are an unintentional mistake made in the financial information raised due to ignorance in accounting principles.

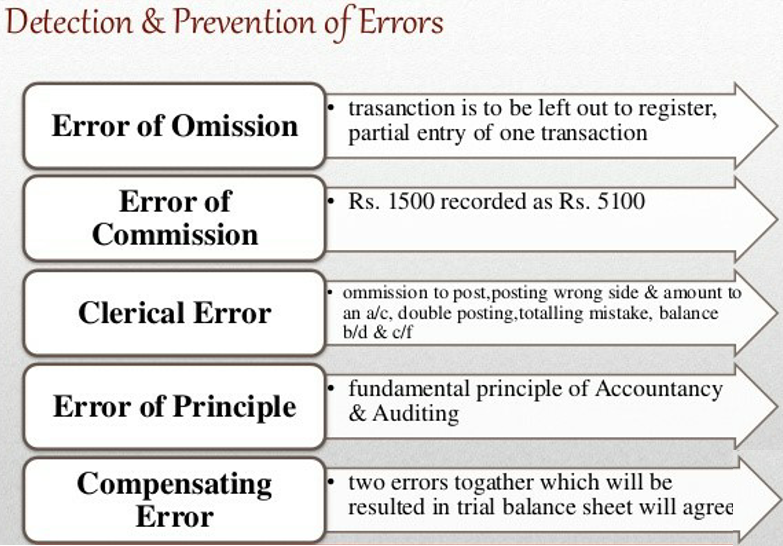

- Some types of error in auditing as per nature:

- Self-revealing errors:- These types of errors in auditing appear during the preparation of accounts. For example, if a cheque deposited is not shown. It becomes apparent during BRS.

- Non-self-revealing errors:- These types of errors in auditing do not appear during the preparation of accounts. These can be known only by detailed analysis. For example, capital expenditure is shown as revenue expenditure.

- Unintentional errors:- These types of errors in auditing are not deliberate mistakes. It may be due to ignorance or oversight of facts. For example, if petty cashier forgets to record freight in the petty cash book.

- Intentional errors:- These types of errors in auditing are deliberate mistakes.

- Unconcealed error: Same as unintentional errors.

- Concealed errors: Whereby the person committing the error is making ways to hide it. These can be ascertained only by detailed checking.

Methods of detecting errors:

Generally, the auditor prepares the trial balance himself. The main objective of the audit is to prepare and present a report based on accuracy, performance, and reliability. The auditor should perform the following functions to detect errors:

- Check the total of trial balance.

- The data of books and accounts must be compared with the amount of balance.

- The auditor should check the balance of books of accounts.

- The auditor should compare the balance of last year with the opening balance of the current year.

- The auditor should check the primary books of the account.

- The auditor should prepare a list of debtors and creditors and such amount should be compared with the amount of trial balance.

- Auditors should check carefully in those areas where there are chances of fraud.

- Auditors should check carefully in those places where there are chances of a specific type of errors.

Prevention of errors:

- In an organization, the physical controls must strengthen that is generally ignored by many, providing physical barriers to the internal fraud or

- Introduce Fraud Awareness Programs within organizations – Fraud awareness creates whistleblowers in organizations which help companies to minimize the risk of fraud and errors.

Please follow and like us: